does nc have sales tax on food

However it is only subject to. This page describes the taxability of.

In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being.

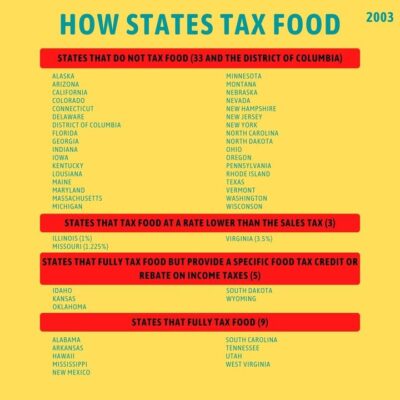

. 53 rows Twenty-three states and DC. To learn more see a full. The local sales tax.

But North Carolina does charge the 2 or 225 percent local sales tax. Statewide North Carolina Sales Tax Rate. A seller that does not have a physical presence in North Carolina and does not have any other legal requirement to register in North Carolina for sales and use tax purposes but sells.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Lowest Effective Sales Tax Rate. Make Your Money Work A number of categories of goods also have different sales tax rates.

County Sales Taxes. We include these in their state sales. The North Carolina NC state sales tax rate is currently 475.

North Carolina Sales Tax. Depending on local municipalities the total tax rate can be as high as 75. At a total sales tax rate of 675 the total cost is 37363 2363 sales tax.

Eleven of the states that exempt groceries from their sales tax base include both. What transactions are generally subject to sales tax in North Carolina. The North Carolina NC state sales tax rate is currently 475.

Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Highest Effective Sales Tax Rate. As of 2014 there were 1012 taxing districts in North Carolina including counties cities and limited meal tax levies.

North Carolina Department of Revenue. Certain items have a 7-percent combined general rate and some items have a miscellaneous. Prescription Drugs are exempt from the North Carolina sales tax.

County and local taxes in most areas. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Treat either candy or soda differently than groceries.

North Carolinas general state sales tax rate is 475 percent. Each of these districts adds its levy to the. When calculating the sales tax for this purchase Steve applies the.

A customer living in Cary North Carolina finds Steves eBay page and purchases a 350 pair of headphones. 35 rows Sales and Use Tax Rates Effective October 1 2020 Skip to main.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Sales Taxes In The United States Wikipedia

Calls Needed Against Unfair Tax Increases

Tax On Restaurant Foods In North Carolina

Sales Taxes In The United States Wikipedia

Texas Sales Tax Basics For Restaurants And Bars Sales Tax Helper

New York City Sales Tax Rate And Calculator 2021 Wise

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Is Food Taxable In North Carolina Taxjar

Sales And Use Tax Rates Effective October 1 2020 Ncdor

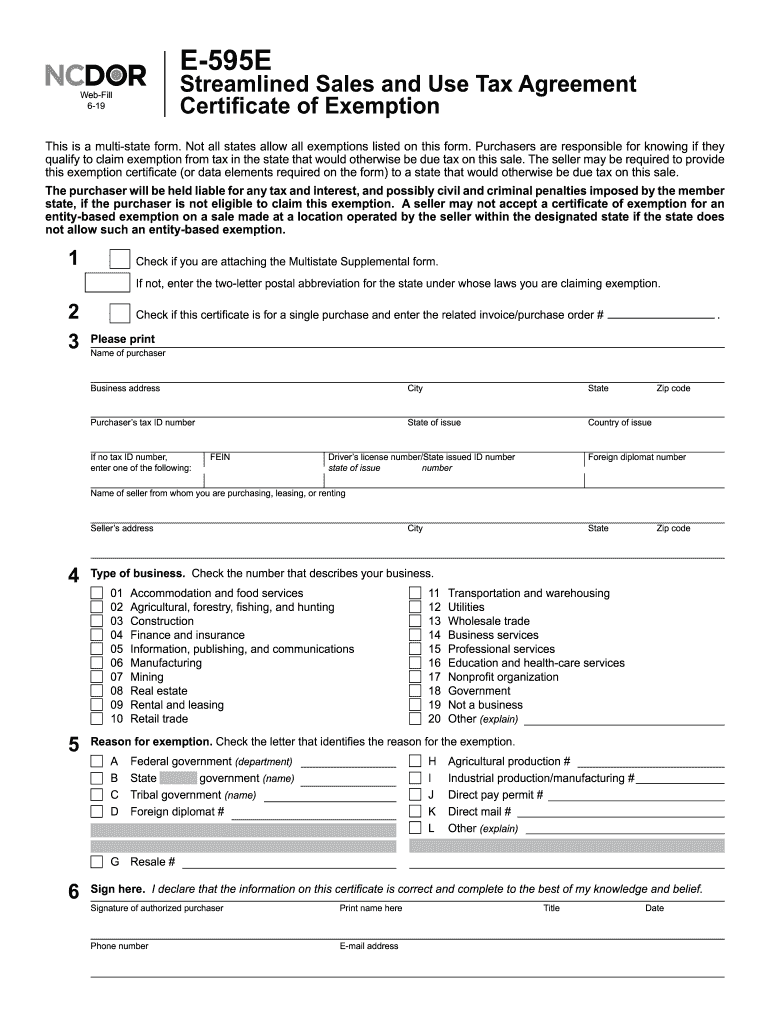

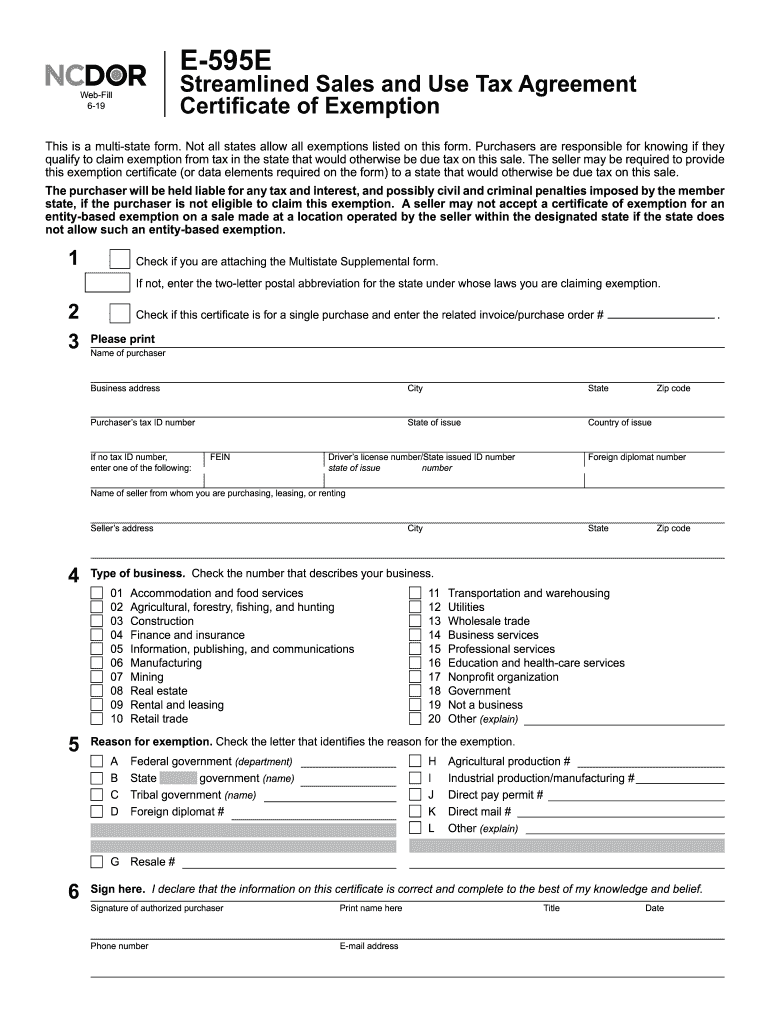

Nc Dor E 595e 2019 2022 Fill Out Tax Template Online Us Legal Forms

Online Farm Taxes Explained Property Equipment And Sales 2022 Center For Environmental Farming Systems

How To Get A Sales Tax Certificate Of Exemption In North Carolina

Food Tax Opponents Say Poor Will Suffer Wral Com

How Are Groceries Candy And Soda Taxed In Your State

Food Tax Repeal Think New Mexico

4 Ways To Calculate Sales Tax Wikihow

North Carolina So Increase Tax On Bread Avalara

North Carolina In 2014 No More Exemption For Food Sold To Students At Colleges And Universities Avalara